When it comes to operating in hazardous environments, safety is paramount. This is where Intrinsically Safe Store comes in, providing a range of intrinsically safe (IS) and explosion-proof equipment designed to prevent accidents and protect lives. But beyond the immediate safety considerations, there are also significant insurance implications to consider. This article will delve into the insurance implications of using intrinsically safe versus explosion-proof equipment.

What is Intrinsically Safe and Explosion-Proof Equipment?

Designers create intrinsically safe equipment to operate in potentially explosive atmospheres without causing ignition. They limit the electrical and thermal energy to levels below what is required to ignite a specific hazardous atmospheric mixture to achieve this.

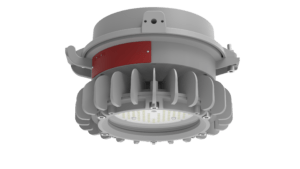

On the other hand, designers build explosion-proof equipment to contain and isolate potential explosions. If an internal explosion occurs, they construct the device to prevent the ignition of the surrounding atmosphere.

Insurance Implications of Using Intrinsically Safe Equipment

Using intrinsically safe equipment can have several positive insurance implications:

Lower Premiums: Insurance companies often offer lower premiums to businesses that use IS equipment. This is because reducing the risk of an explosion or fire significantly lowers the potential for costly claims.

Reduced Liability: By using IS equipment, businesses can demonstrate a commitment to safety, which can help reduce liability in the event of an accident.

Compliance with Regulations: Many industries are required by law to use IS equipment in certain hazardous environments. Compliance with these regulations can help avoid costly fines and legal issues, which can also impact insurance premiums.

Insurance Implications of Using Explosion-Proof Equipment

While explosion-proof equipment also offers safety benefits, the insurance implications can be different:

Higher Premiums: Because explosion-proof equipment is designed to contain an explosion rather than prevent it, there may be a higher risk associated with its use. This can result in higher insurance premium

Potential for Increased Liability: If an explosion does occur, the damage can be extensive, potentially leading to higher liability claims.

Case Study: The Impact of Equipment Choice on Insurance

The National Fire Protection Association (NFPA) conducted a 2018 study revealing that businesses using IS equipment made 60% fewer insurance claims related to fire or explosion incidents compared to businesses using explosion-proof equipment. This clearly demonstrates the potential insurance benefits of choosing IS equipment.

Making the Right Choice for Your Business

Choosing between intrinsically safe and explosion-proof equipment is a critical decision that can have significant insurance implications. While both types of equipment offer safety benefits, the potential for lower insurance premiums and reduced liability makes IS equipment an attractive option for many businesses.

At the Intrinsically Safe Store, we understand the importance of making the right choice for your business. We offer a wide range of IS equipment designed to meet the needs of various industries. Visit our website to learn more about our products and how they can help you improve safety and manage insurance costs.

If you have any questions or need further advice on choosing the right equipment for your business, don’t hesitate to contact us. Our team of experts is always ready to help.